Chris Kelly, CEO of HomeServices of America, Addresses Housing Market Stability Amid Steady Interest Rates

HomeServices of America CEO provides perspective on housing market stability and interest rates

MINNEAPOLIS, MN, UNITED STATES, January 14, 2026 /EINPresswire.com/ -- For the past three years, discussions surrounding the U.S. housing market have largely focused on the trajectory of mortgage interest rates, particularly whether rates will return to historically low levels.Mortgage rates near 3 percent, while widely referenced, were the result of extraordinary economic conditions. Those rates were implemented primarily during the COVID-19 pandemic as a temporary measure to stimulate economic activity and are not reflective of long-term housing market norms. Available data indicates that rates at those levels are unlikely to return in the foreseeable future.

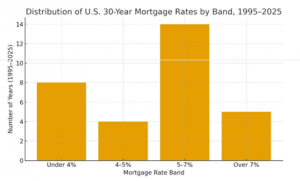

Historically, mortgage interest rates have operated at higher levels. Even during periods commonly associated with affordability, including the 1950s, mortgage rates averaged closer to 4 percent. As a result, real estate professionals, lenders and industry leaders are tasked with providing consumers an accurate understanding of current market conditions, rather than reinforcing expectations tied to atypical periods.

When viewed through a historical lens, today’s housing market reflects a return to more traditional conditions rather than a departure from them.

Over the past 30 years, the most common range for a 30-year fixed-rate mortgage in the United States has been between 5 percent and 7 percent, with a long-term midpoint of approximately 6 to 6.5 percent. The extended period of lower rates during the 2010s and the brief decline below 3 percent during the pandemic, represent exceptions rather than the rule.

Despite this context, some industry discussions continue to reference those years as a baseline. That framing has implications for consumer behavior, particularly when market messaging is narrowly focused on incremental rate fluctuations.

“Housing decisions have never been driven by interest rates alone,” said Chris Kelly, CEO of HomeServices of America. “Rates are one factor, but long-term affordability, mobility, equity and personal circumstances all play a meaningful role in how consumers approach buying and selling decisions.”

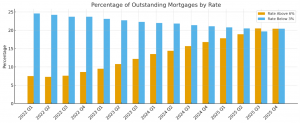

Current data suggests a more nuanced market environment than many headlines imply. One notable shift is occurring within the composition of outstanding mortgages in the United States. For the first time since the pandemic, the number of mortgages with interest rates above 6 percent is roughly equal to the number below 3 percent. This shift indicates a gradual easing of the so-called “lock-in effect,” which has limited housing inventory and homeowner mobility.

As the share of ultra-low-rate mortgages declines, fewer homeowners remain anchored to rates that previously discouraged movement. In addition, many homeowners who retain low first-mortgage rates have accessed home equity through secondary loans or lines of credit, often at rates exceeding 7 percent. This has further reduced the relative financial advantage of remaining in place. The result has been a gradual and measured normalization of market behavior rather than a sudden increase in housing inventory.

This environment requires a different approach from the real estate industry than what prevailed during periods of unusually low interest rates. Greater emphasis is being placed on consumer education, pricing discipline and clear communication around value.

Affordability discussions increasingly extend beyond interest rates to include monthly payments, equity considerations, mobility, lifestyle priorities and long-term financial objectives. Interest rates remain an important variable, but they are not the sole determinant of housing market participation.

Markets operating within historical norms tend to be more stable and sustainable over time. Such conditions reward preparation, professionalism and informed decision-making.

As the housing market continues to adjust, industry messaging is expected to reflect these realities with clarity and consistency.

Israel Kreps

Kreps PR & Marketing

email us here

Visit us on social media:

LinkedIn

Instagram

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.